Urad (Black Matpe) Market Update – October 4, 2025

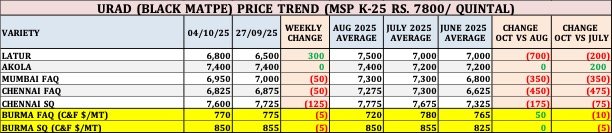

Urad (Black Matpe) Market Update – October 4, 2025 MSP: Rs 7,800 per quintal ★ Prices of urad (black matpe) in major Indian markets showed a mixed trend this week (October 4, 2025) compared to last week (September 27, 2025). However, compared to the average prices of August 2025, most centers recorded a decline. Latur: ★ Urad prices stood at Rs 6,800 per quintal, up Rs 300 from last week. However, compared to the August average of Rs 7,500, prices were still Rs 700 lower. Akola: ★ Prices remained steady at Rs 7,400 per quintal, unchanged from both last week and the August average. Mumbai (FAQ): ★ Prices dropped from Rs 7,000 to Rs 6,950 per quintal — a weekly fall of Rs 50. Compared to the August average of Rs 7,300, prices remain Rs 350 lower. Chennai: ★ Urad FAQ prices declined from Rs 6,875 to Rs 6,825 per quintal — a weekly drop of Rs 50. Compared to August, prices are down by Rs 450. ★ SQ variety prices fell from Rs 7,725 to Rs 7,600 per quintal — a weekly drop of Rs 125. Compared to the August average of Rs 7,775, prices are Rs 175 lower. ~~~~~~~~~ Burma Market (C&F $/MT): ★ Burma FAQ prices slipped from $775 to $770 per metric ton, down $5 week-on-week. However, prices remain $50 higher than the August average of $720. ★ Burma SQ also fell from $855 to $850 per metric ton, down $5, remaining at the same level as the August average. ~~~~~~~~~ Myanmar Export and Stock Situation: ★ According to OATA, Myanmar exported 6.64 lakh tonnes of urad between January and September 2025, compared to 7.3 lakh tonnes in the same period last year. ★ During September 2025, Myanmar recorded a new monthly export high of 1.15 lakh tonnes, out of which India imported 92,215 tonnes. ★ In 2024, the highest monthly export volume was 1.02 lakh tonnes, recorded in May. ★ Myanmar achieved a record production of 10 lakh tonnes of urad previous season, of which 6.6 lakh tonnes were exported and around 1 lakh tonnes consumed domestically. The country currently holds around 2.5 lakh tonnes of stock. With the new crop expected in February–March, this remaining stock is likely to be exported over the next five months. ★ Overall data indicates that Myanmar’s stock levels are gradually tightening, while Brazilian urad prices remain extremely high. ~~~~~~ India Imports and Crop Situation: ★ India’s urad imports between April and July 2025 totaled 2.3 lakh tonnes, slightly lower than 2.56 lakh tonnes during the same period last year. ★ Recent heavy rains have caused some crop damage in India, though new arrivals have begun in a few states. High moisture content in the freshly harvested lots has led to lower trading prices. ★ According to government data, India’s kharif urad production has been as follows: ★ 2021-22: 18.65 lakh tonnes ,2022-23: 17.68 lakh tonnes, 2023-24: 16 lakh tonnes, 2024-25: 13 lakh tonnes. ★ Production has been declining consistently each year. For 2025-26, output is also expected to remain below 12 lakh tonnes. ★ Considering the current situation and available data, the medium- to long-term outlook for urad appears firm. Declining domestic production, tightening stocks in Myanmar, and higher global prices are likely to support the market in the coming months. Important Disclaimer: This report is for informational purposes only I-Grain India does not take any responsibility for profits or losses and does not promote any specific market movement (bullish or bearish). *Please make decisions based on your own judgment and understanding.