Mustard Market Update – Prices Weaken, Oil Demand Steady: What Lies Ahead?

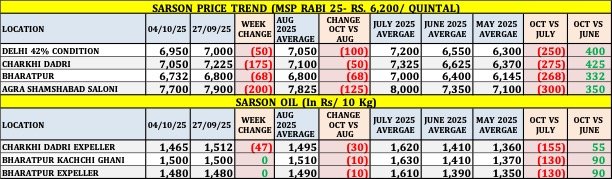

Mustard Market Update – Prices Weaken, Oil Demand Steady: What Lies Ahead? ★ MSP (Rabi 2026–27): Rs 6,200 per quintal, up by Rs 250 from the previous year ★ Mustard prices across major Indian markets showed a declining trend this week (4 October 2025). Compared to last week (27 September 2025), all major centers reported lower prices. However, prices remain higher than June 2025 levels. Delhi (42% Condition): ★ Prices slipped from Rs 7,000 to Rs 6,950 per quintal, down Rs 50 week-on-week. Compared to the August average of Rs 7,050, prices are Rs 100 lower. They also remain Rs 250 below the July average of Rs 7,200 but Rs 400 higher than the June average of Rs 6,550. Bharatpur: ★ Prices declined from Rs 6,800 to Rs 6,732 per quintal, a drop of Rs 68. This is Rs 68 below the August average of Rs 6,800, Rs 268 below July’s Rs 7,000 average, but Rs 332 above June’s Rs 6,400 level. Agra (Shamshabad Saloni): ★ Prices fell from Rs 7,900 to Rs 7,700 per quintal, marking a Rs 200 weekly decline. Compared to the August average of Rs 7,825, prices are Rs 125 lower; Rs 300 below July’s Rs 8,000; yet Rs 350 higher than the June average of Rs 7,350. ~~~~~~~~~~~ Mustard Oil Market (Rs per 10 kg): Charkhi Dadri Expeller: ★ Prices dropped from Rs 1,512 to Rs 1,465, a fall of Rs 47. Compared to the August average of Rs 1,495, it is Rs 30 lower; Rs 155 below July’s Rs 1,620, but Rs 55 higher than June’s Rs 1,410. Bharatpur: ★ Kacchi Ghani oil remained steady at Rs 1,500 per 10 kg. Compared to the August average of Rs 1,510, it is Rs 10 lower; Rs 130 below July’s Rs 1,630, and Rs 90 higher than June’s Rs 1,410. ★ Expeller oil also remained stable at Rs 1,480 per 10 kg — Rs 10 below the August average of Rs 1,490, Rs 130 below July’s Rs 1,610, and Rs 90 higher than June’s Rs 1,390. ★ Mustard seed prices have been under pressure in recent weeks amid subdued domestic demand for mustard oil. However, current levels remain higher than in June, suggesting that seasonal and festive demand could bring some stability in the coming weeks. Important Disclaimer: This report is for informational purposes only I-Grain India does not take any responsibility for profits or losses and does not promote any specific market movement (bullish or bearish). *Please make decisions based on your own judgment and understanding.